CARDINAL HEALTH (CAH)·Q2 2026 Earnings Summary

Cardinal Health Crushes Earnings, Raises FY26 Outlook as All Segments Fire

February 5, 2026 · by Fintool AI Agent

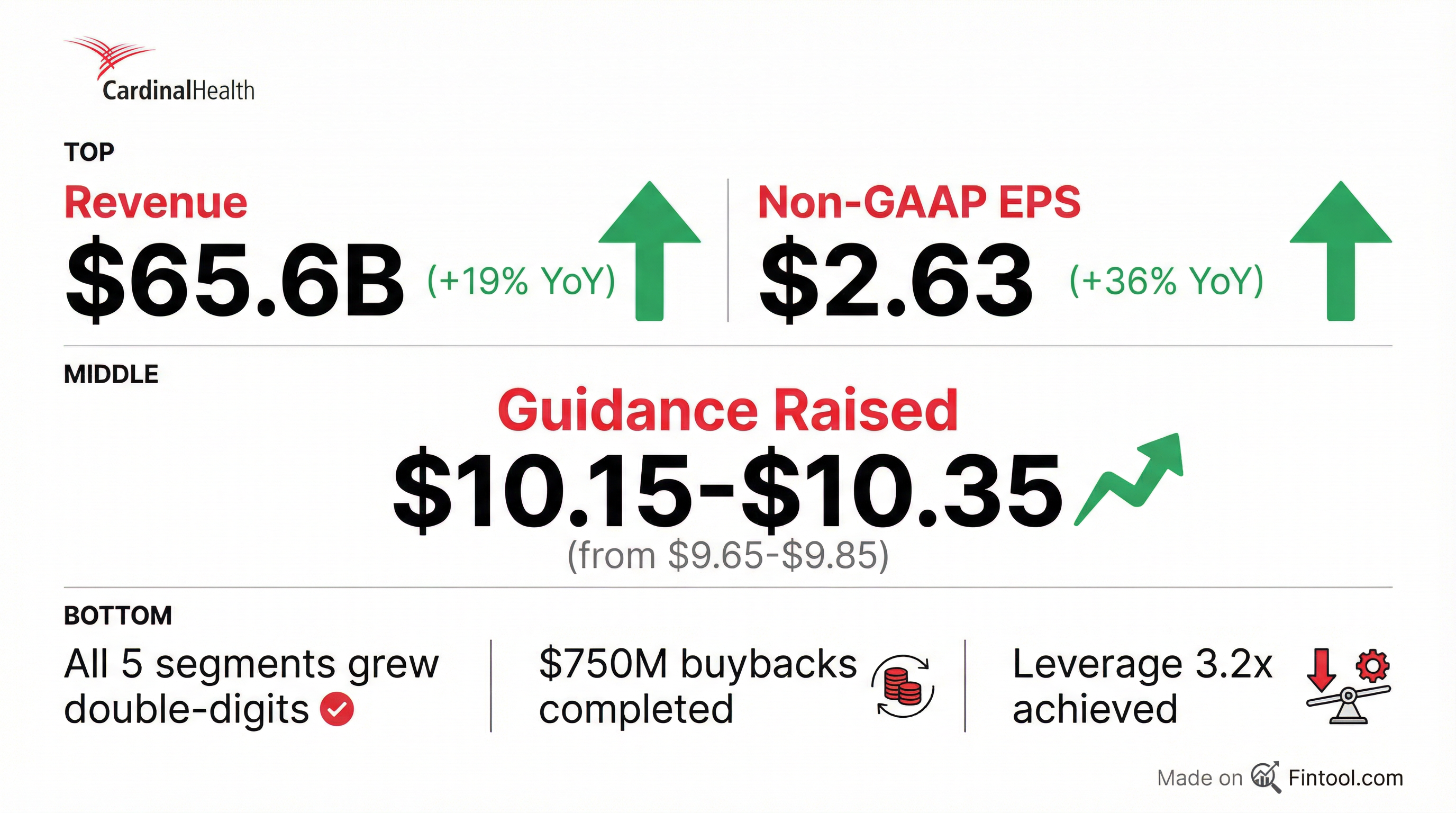

Cardinal Health (NYSE: CAH) delivered a standout Q2 FY26, beating revenue and EPS estimates by double-digit percentages while raising full-year guidance. Total revenue increased 19% to $66 billion, driven by continued strong demand within Pharmaceutical and Specialty Solutions. All five operating segments posted double-digit profit growth, validating management's turnaround strategy and specialty healthcare expansion.

Despite the strong results, shares fell ~5% during the trading session before recovering to near-flat in aftermarket trading at $217.19—suggesting investors used the rally as a profit-taking opportunity after the stock's 70%+ gain over the past year.

Did Cardinal Health Beat Earnings?

Yes—decisively. Cardinal Health beat on both revenue and EPS with significant upside:

The 36% Non-GAAP EPS growth reflects both operating leverage and capital allocation discipline, with share count down ~2% YoY following $750M in repurchases (weighted average price of $173/share).

"The Cardinal Health team has delivered another excellent quarter, driven by broad-based performance across the enterprise... What stands out to me most in this quarter's performance is the balance of results across our portfolio as we achieve strong profit growth of at least double digits from all five of our operating segments."

— Jason Hollar, CEO

What Did Management Guide?

Cardinal Health raised FY26 guidance across all metrics, signaling strong conviction in second-half performance:

The updated EPS range of $10.15-$10.35 represents 23-26% YoY EPS growth—a meaningful revision driven by operational outperformance. Management expects mid-teens profit growth in H2 for Pharma as they lap $10B of new customer revenue and prior M&A.

What Changed From Last Quarter?

Segment Performance: All Cylinders Firing

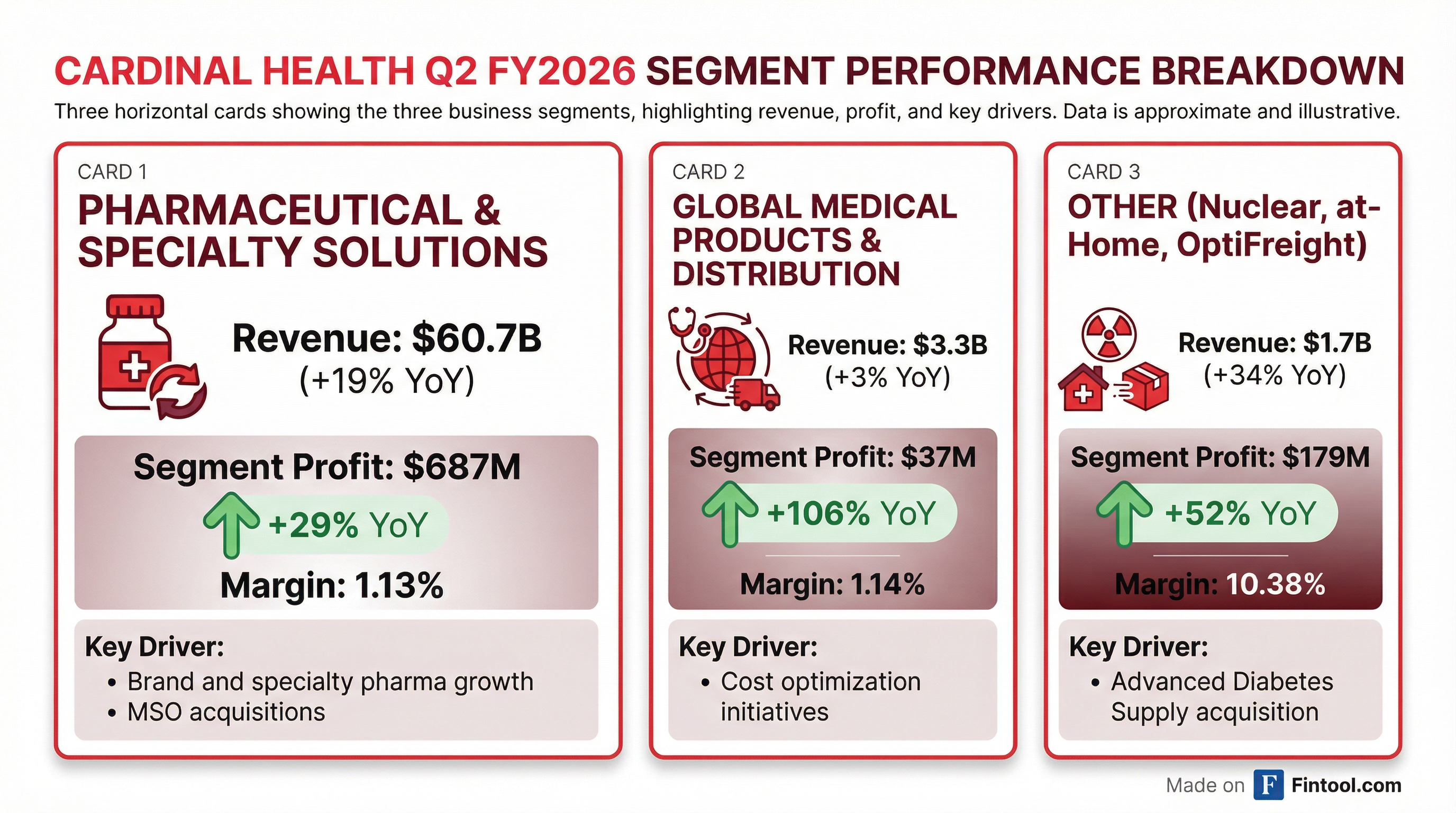

Every segment delivered, with the GMPD turnaround story finally showing concrete results:

Key segment drivers:

- Pharma & Specialty: Brand and specialty growth from existing and new customers; ~6 percentage points of revenue growth from GLP-1 sales; MSO platform contributions; strong generics program with healthy unit growth exceeding long-term expectations

- Medical Products: Volume growth from existing customers + cost optimization initiatives (partially offset by adverse tariff impact); Cardinal Health Brand portfolio grew 10% in the US (though 3-4 percentage points was timing-related distributor restocking)

- Other: Growth across At-Home Solutions (including ADS acquisition), OptiFreight Logistics (revenue growth >30%), and Nuclear/Precision Health Solutions (Theranostics revenue growth >30%)

GMPD Turnaround Gaining Traction

The 106% profit growth in Global Medical Products and Distribution is the highlight of the quarter. Segment margin expanded to 1.14%—still thin, but the trajectory is clearly improving after years of restructuring.

Management noted tariffs remain a headwind, but cost optimization is more than offsetting the impact. The raised segment profit guidance to ~$150M suggests confidence in continued momentum. Note: Some Q2 outperformance (3-4 percentage points of Cardinal Health Brand growth) was timing-related from distributor restocking, expected to normalize in Q3.

Specialty Strategy Executing

The Specialty Alliance continues to scale with the Solaris Health acquisition (completed early November), positioning CAH as the country's leading multi-specialty MSO platform. Management announced the first urology practice was added under the new structure in Michigan.

Specialty revenues are expected to surpass $50 billion in FY26, up from prior disclosures, reflecting momentum across distribution, MSO platforms, and Biopharma Solutions.

Biopharma Solutions highlights:

- Sonexus Access and Patient Support business added over 1 million new patients served from recent manufacturer partner wins

- 3PL business supported ~50% of all new specialty product launches in calendar 2025

- Management reiterated the $1 billion revenue target by FY28 for Biopharma Services, with Sonexus driving half of the growth

"Our strategic focus on specialty is delivering tangible results... We expect our specialty revenues will surpass $50 billion in fiscal 2026, a testament to our progress in this high-growth, higher-margin space."

— Jason Hollar, CEO

Other Growth Businesses Shine

The "Other" segment continues to outperform with all three businesses delivering double-digit core profit growth:

- Nuclear & Precision Health Solutions: Theranostics revenue growth exceeded 30%; business has 70+ products in pipeline dominated by novel theranostics in oncology and urology; customer survey yielded NPS "well above industry average"

- At-Home Solutions: ADS integration progressing well; ContinuCare Pathway program now supports 11,000+ pharmacies with new Publix partnership announced

- OptiFreight Logistics: Revenue growth exceeded 30%; new customers and expanded utilization driving significant inbound/outbound shipment growth

Watch for Q3: Management noted tougher Theranostics comps starting Q3 as they lap strong product launches from last year, and ADS acquisition will be lapped in Q4.

How Did the Stock React?

The stock's intraday weakness despite strong results likely reflects:

- Profit-taking after a massive run (stock up ~70% over past 12 months)

- Valuation concerns as CAH trades near all-time highs

- Elevated expectations that were already baked in

The aftermarket recovery to $217.19 suggests investors digested the guidance raise positively once the initial selling pressure subsided.

Key Metrics & Trends (8-Quarter History)

Values retrieved from S&P Global and company filings.

The trend is unmistakable: Q2 FY26 marks the 6th consecutive quarter of accelerating Non-GAAP EPS growth on a YoY basis.

Capital Allocation Update

Cardinal Health continues its disciplined approach:

Reaching the targeted leverage range ahead of schedule provides flexibility for additional opportunistic share repurchases or tuck-in M&A. CFO Aaron Alt noted: "We are pleased that both internally and externally there is competition for our capital."

Q&A Highlights

Key themes from the investor Q&A:

On Organic vs. Inorganic Growth: CEO Jason Hollar noted that M&A is expected to contribute ~8% of Pharma segment profit growth for FY26, emphasizing that "the core is strong and our organic investments and priorities continue to drive the business forward."

On GLP-1 Outlook: Management sees no material change in economics despite the shift to oral formulations. The cost to serve is slightly better for orals vs. injectables, but GLP-1s overall are not expected to be a meaningful profit driver—more of a revenue contributor. Both injectable and oral formats expected to grow significantly in the near term.

On Second-Half Outlook: CFO Aaron Alt clarified that mid-teens profit growth in H2 for Pharma reflects lapping $10B of new customer revenue and prior M&A (Ion, GIA)—not demand deceleration. Management has factored in stronger-than-originally-expected demand but is not assuming "outsized demand" continues.

On Capital Allocation: With leverage back in the targeted 2.75x-3.25x range ahead of schedule, management has "flexibility to assess how we will create the most shareholder value." M&A focus remains on smaller tuck-ins for MSO platforms and At-Home, with an emphasis on offensive rather than defensive actions.

On IRA Impact: Management confirmed successful DSA fee negotiations on all 26 Medicare items to preserve margins, and sees no reason to expect different outcomes for items in 2027 and 2028. Revenue may be impacted by WAC adjustments, but margins should remain stable.

On GMPD Progress: The improvement plan is yielding results through focus on "the basics"—capacity investments, lower back orders, and service levels "that we've just not seen before." Cardinal Health Brand growth is primarily in clinically differentiated categories like the SmartFlow compression device.

Risks & Watch Items

While results were strong, investors should monitor:

-

Tariff Exposure in Medical Products: Management noted adverse tariff impacts partially offset gains in GMPD. New tariff actions could pressure margins.

-

Timing Normalization: Some Q2 GMPD strength (3-4 percentage points of Cardinal Health Brand growth) was from distributor restocking timing, expected to reverse in Q3.

-

Integration Risk: Multiple acquisitions (Solaris Health, ADS, MSO platforms) require successful integration; management noted lapping ADS in Q4.

-

Tougher Comps Ahead: Theranostics faces tough Q3 comps from prior year product launches; Pharma lapping $10B new customer in H2.

Forward Catalysts

- Q3 FY26 Earnings: Expected early May 2026; watch for GMPD sequential profit growth and Theranostics performance vs. tough comps

- Solaris Distribution: If Solaris distribution moves to Cardinal Health, it would be toward end of fiscal year—not currently in guidance

- Specialty Expansion: Continued MSO platform provider additions; focus on oncology, autoimmune, and urology platforms

- Biopharma Solutions: Path to $1B revenue by FY28 with Sonexus driving half of growth

- Capital Deployment: With baseline share repurchases complete and leverage in range, watch for opportunistic M&A or additional buybacks

Bottom Line

Cardinal Health delivered an exceptional Q2 FY26 with beats on every metric that matters. The GMPD turnaround is real, specialty expansion is executing, and capital allocation remains disciplined. The guidance raise to $10.15-$10.35 EPS (+23-26% YoY) reflects management confidence in sustained momentum.

The stock's intraday weakness is a healthy consolidation after a massive run rather than a sign of fundamental concern. For investors, the key question is whether 20%+ earnings growth can continue into FY27 and beyond as comparisons get tougher—management's conservative second-half guidance philosophy suggests they're leaving room for upside.

Data sources: Cardinal Health Q2 FY26 Earnings Call Transcript, 8-K Filing, Press Release. Estimates from S&P Global.